Step 1: Establishing the need

“What would happen to your lifestyle if you were sick or hurt for a year or more and could not work?” This simple question or some variation of it, such as “Can you afford to retire right now?” is the first step in the sales process.

Disability insurance must be sold. No one likes to think about being sick or hurt. If you wait for someone to ask for it, you can usually expect health concerns that will make underwriting difficult. So you must help your clients to consider an unpleasant scenario—not being able to work. From there, a quick tour of their financial situation will show that most clients not only have little in savings, but have significant debt. A loss of income for even a few months would be devastating for most Americans.

A story at this point about someone who really needed their disability insurance and how helpful it was is often useful.

If the need is firmly established in the client’s imagination, then getting a quote and discussing the policy becomes easy. Solutions are meaningful only when a perceived problem exists.

Be proactive. If you effectively create the need for owning Disability Income Insurance, then the probability of a sale goes way up. Once the need is created then a solution or a disability proposal can be presented. The fact that a need was filled also increases the likelihood that the policy stays in force and does not lapse.

As a point of interest, a lesson can be learned from the “old pros” who sell large amounts of Disability Insurance. First, they are passionate about selling Disability Income Insurance and secondly, they always talk to all their clients about the need. So have conviction and always remember to develop the need before the solution is presented.

Step 2: Income as the basis of all financial planning

As an agent marketing Disability Income Insurance you must understand why it is so critical to protect your client’s income. Without income, all else can be lost – your ability to feed your family, make the house payment, the car payment, tuition for the kids, and investments that will sustain you during retirement. In short, you must have income to protect your lifestyle. If you need your income, you need to protect it. A practical way to get your client to fully understand the critical nature of protecting income would be to ask a series of probing questions.

How long would your income continue if you had an accident or a serious sickness?

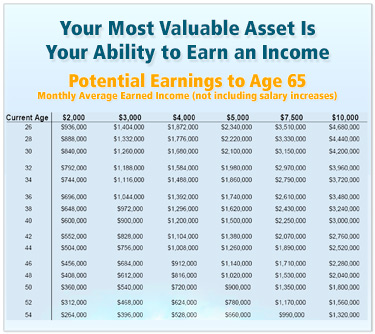

At this point you could show your client a sales piece that illustrates the earnings potential they have:

If your income stopped because of an accident or a sickness, how long would it be before this would be a problem – 3 months, 6 months, a year?

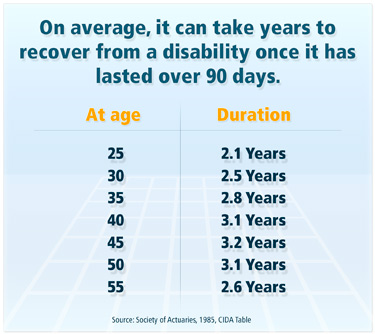

At this point you could show the client some statistics on claims:

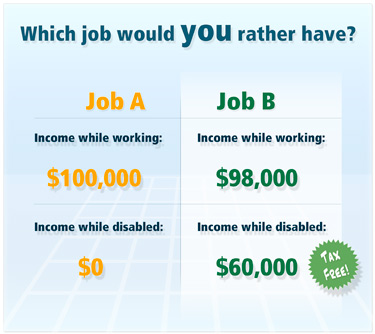

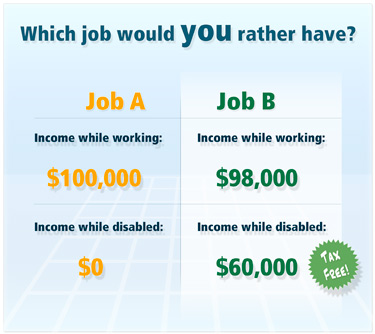

Prepare your client for the cost. In the world of cheap 20 year term life insurance policies, disability insurance can seem expensive. We tell clients to expect to pay between 1.5% and 3% of their income for a high quality policy. This moment is a great time to use Job A, Job B—a sales presentation idea that is almost as old as disability insurance.

The client has a choice between Job A—which pays 100% of salary if well and 0% if sick or hurt—and Job B which pays 98% of the salary if well and 60% if sick or hurt. No one ever picks Job A when presented like this.

Which job would YOU rather have?

Step 3: The Mechanics

Once we have established the need and the importance of protecting income, then we can move on to the mechanics which are as follows.

- Fact – finding

- Council with us to create a solution – the formal proposal.

- The formal presentation

- Repeat or reinforce some statistics or catchy sales idea