Disability Insurance: Selling and Training

Understanding

Disability Insurance

Disability Insurance is Income Protection

Disability Insurance, often called DI or disability income insurance, or income protection, is a form of insurance that insures the beneficiary's earned income against the risk that a disability creates a barrier for a worker to complete the core functions of their work. For example, the worker may suffer from an inability to maintain composure in the case of psychological disorders or an injury, illness or condition that causes physical impairment or incapacity to work. It encompasses paid sick leave, short-term disability benefits (STD), and long-term disability benefits (LTD).

Statistics show that in the US a disabling accident occurs, on average, once every second. In fact, nearly 18.5% of Americans are currently living with a disability, and 1 out of every 4 persons in the US workforce will suffer a disabling injury before retirement.

Understanding The Underwriting Process

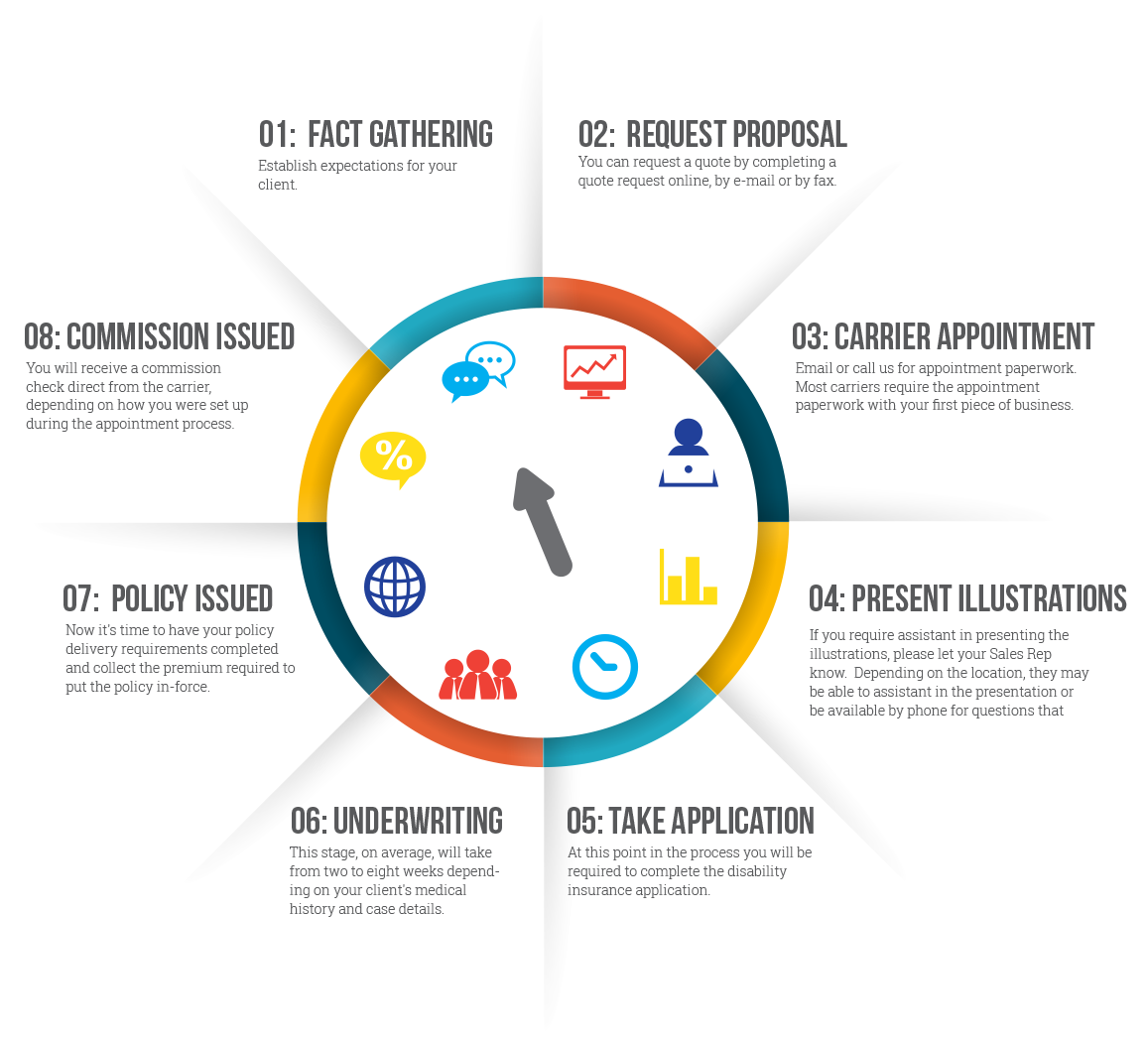

It only takes eight simple steps to completely underwrite a disability insurance policy.

Fact Gathering

Establish expectations for your client - we have a Disability Fact Finder available to help you collect the needed information. This is a "tough but fair" process in which you establish expectations for your client. You will also collect the following information from him/her:

- Client Name

- Date of Birth

- Tobacco use

- Gender

- Occupation/Duties

- Net Income

- State of Residence

- Medical History

- Medications

Request a Proposal

You can request a quote by completing a quote request online at dibrokereast.com, emailing the request to quoteteam@dibrokereast.com, faxing it to 305-448-2022 or calling it in to our team.

Present Illustrations

If you require assistant in presenting the illustrations, please let your Sales Rep know. Depending on the location, they may be able to assistant in the presentation or be available by phone for questions that come up.

Take Application

At this point in the process you will help your client complete the disability insurance application, either on paper or on-line. Most carriers now have a teleapp in which they ask most of the health and financial questions for you - you just have to collect their basic contact information and fill out the portion regarding the details of the policy for which they are applying. You may also have to gather income and other financial documentation as needed by the underwriter. We can answer any questions you might have regarding this process or about the application and we schedule the teleapp and paramed for you if needed and if you want us to. PDF applications can be downloaded from our website or we can email them to you.

Underwriting

This stage takes place at the home office of the carrier to which your client has applied. On average it will take from two to eight weeks depending on your client's medical history and case details—attending physician statements (APS) are the items most likely to slow this process down. During this time you will receive at least weekly status updates in your inbox (unless you opt out) and you can review your client's case status online with DIBroker East's Broker Services.

How to Start Selling Disability

An Introduction To Selling Disability Insurance

The following resources below are available FREE for your use. They cover the basic and intermediate training levels of Disability insurance. Complete the training below and join Broker Services to start selling DI today!

First, Read about why you need disability insurance.

An overview of the concepts related to disability insurance. Learn to understand your client’s occupation. What does he do on a daily basis?

An outline of the concepts related to disability insurance. The most fundamental idea is that disability insurance replaces lost income in the event of injury or illness that prevents your client from being able to earn a living.

A glossary to refer to important disability insurance definitions. All your disability insurance terms defined, from A to Z.

Disability Insurance Courses

How do you find success in the disability insurance market? First, establish the need. Second, realize your client's income as the basis for financial planning. Third, understand the mechanics of DI.

Learn how lining up your clients needs with what he or she can afford is the most critical aspect of helping your client choose a policy.

Writing multiple lives at the same work place or in the same association can bring the costs down for your clients—while still maintaining all of the advantages of an individual policy.